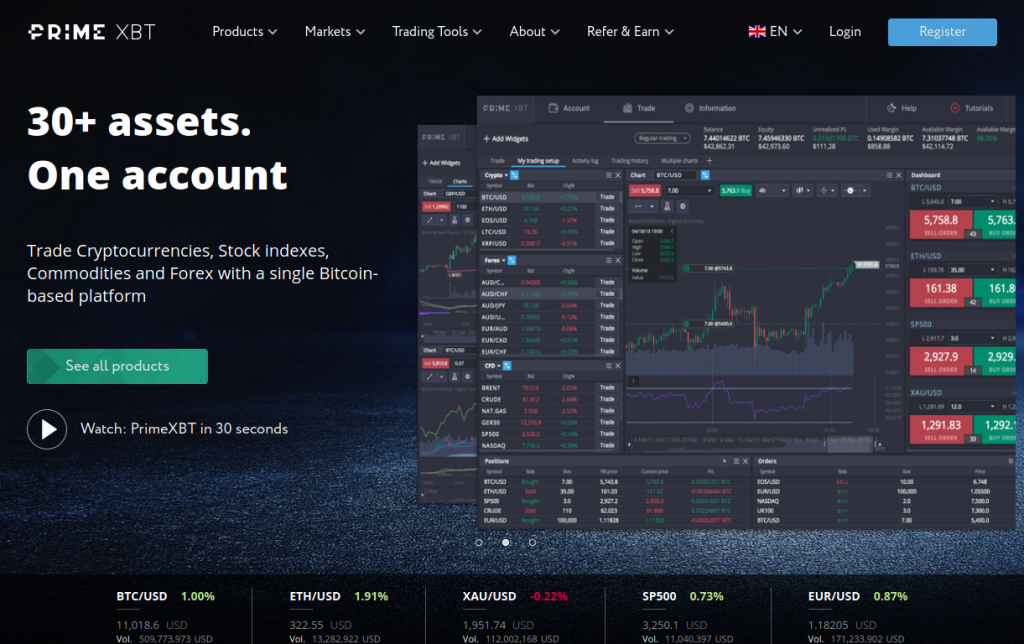

Understanding Limits on PrimeXBT: A Comprehensive Guide to Trading

When navigating the dynamic landscape of cryptocurrency trading, understanding the limits on platforms like PrimeXBT is essential for success. Limits on PrimeXBT entail various restrictions and guidelines that can significantly influence a trader’s strategy and risk management approach. For those eager to learn more about these limits, you can visit Limits PrimeXBT https://tradingprimexbt.com/limits/ for detailed insights.

What Are Trading Limits?

Trading limits are regulations set by trading platforms to ensure a manageable level of risk. In the context of PrimeXBT, these limits can pertain to various aspects of trading, including maximum leverage, minimum account sizes, and daily withdrawal limits. These constraints are critical for maintaining a secure trading environment and protecting both the platform and its users.

The Importance of Leverage

One of the most significant limits on PrimeXBT is related to leverage. Leverage allows traders to control larger positions than their initial capital would normally permit. While this can amplify profits, it also increases potential losses. Hence, PrimeXBT has implemented certain leverage limits to manage risk effectively. Understanding how leverage works, and the limits associated with it, is a foundational aspect of becoming a proficient trader.

Minimum Deposit and Trading Sizes

Another important limit involves minimum deposit requirements and trade sizes. PrimeXBT has established these parameters to ensure that all traders are adequately capitalized to engage in trading effectively. By enforcing minimum trade sizes, the platform enhances market stability and prevents excessive market volatility stemming from smaller, less impactful trades.

Daily Withdrawal Limits

Daily withdrawal limits are another critical aspect of trading on PrimeXBT. These limits play a crucial role in ensuring the platform’s liquidity and security. Understanding how these limits work can help traders plan their investments and manage their funds more effectively. For those looking to withdraw significant amounts, it is essential to be aware of these limits to avoid any surprises during withdrawal processes.

Risk Management and Trading Strategy

Implementing an effective risk management strategy is vital for maximizing profits while minimizing losses in trading. With the various limits in place on PrimeXBT, traders must adapt their strategies accordingly. Here are some practical tips:

- Know Your Limits: Familiarize yourself with all the limits, including leverage, minimum trade size, and withdrawal limits to tailor your trading strategy effectively.

- Implement Stop-Loss Orders: Utilize stop-loss orders to manage risk effectively, especially when trading with high leverage.

- Diversify Your Portfolio: Avoid putting all your capital into one trade or asset. Diversification can help mitigate risks associated with market volatility.

- Educate Yourself: Continuous education about market trends, trading limits, and strategies can significantly bolster your trading performance.

Conclusion

In conclusion, understanding the various limits on PrimeXBT is critical for both new and seasoned traders. These limits, including leverage, minimum deposits, trade sizes, and withdrawal restrictions, play an integral role in maintaining a secure trading environment and minimizing potential risks. By thoroughly understanding these aspects and implementing effective trading strategies, traders can optimize their experience on PrimeXBT and potentially increase their profit margins.

Whether you are just starting your trading journey or have been trading for years, being aware of and adapting to the limits set by PrimeXBT is imperative for long-term success. Embrace these limitations as part of your trading strategy, and you’ll find that they can enhance rather than hinder your trading endeavors.